Foreclosures have slowed down this month across the nation not because people are staying current on their mortgages but because the banks are facing scrutiny over their foreclosure proceedings. This is really a big issue for states that use judicial foreclosure which California does not, but Californian’s are getting the benefit from the slow down as some banks have voluntarily stopped foreclosures for this month. I was going to file a chapter 7 case in which we surrendered the house last week a day before the date of sale at a trustee sale but a day before that the title company halted the foreclosure. It is now scheduled one month out which buys my client another month to live in his house for free and once he files he’ll get another 2-4 months before they can foreclose again. In his case he can’t afford his house and its 50% underwater so he had not intention of trying to keep it but it will allow him to save some money and be in a better position to move and get a fresh start once his bankruptcy case is filed and he gets a discharge. For people trying to save money to get caught up in their arrearages and still be able to file a chapter 7 this moratorium is a blessing, for others it just stalls the inevitable but gives them a place to stay for longer.

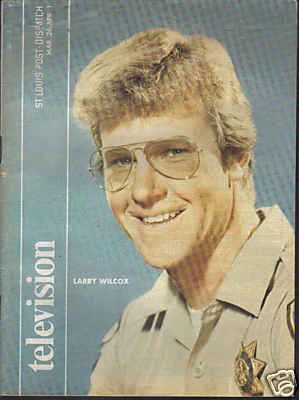

Larry Wilcox from Chips file for Bankruptcy

Former Chips star Larry Wilcox file for Bankruptcy amid criminal charges brought by the SEC. This story was particularly interesting to me as Larry Wilcox was a bit of a hero to me as a kid and over the last 5 years I have been told that I look just like him. He has 1.5 million dollars in debt and owes an enormous amount in back taxes. This case will be interesting to follow as he has also been charged with being a part of an organized company that sold fake stock certificates. Its hard to believe that someone who played the clean role of Chips actor is involved in a criminal enterprise.

Former Chips star Larry Wilcox file for Bankruptcy amid criminal charges brought by the SEC. This story was particularly interesting to me as Larry Wilcox was a bit of a hero to me as a kid and over the last 5 years I have been told that I look just like him. He has 1.5 million dollars in debt and owes an enormous amount in back taxes. This case will be interesting to follow as he has also been charged with being a part of an organized company that sold fake stock certificates. Its hard to believe that someone who played the clean role of Chips actor is involved in a criminal enterprise.

Wage garnishment can take 25% while bankruptcy can wipe it out or reduce payment

If you have recently been sued or have a judgment against you its only a matter of time before a sheriff will be contacting your employer and levying your wages through a garnishment. In California a creditor can take 25% of your net wages. If you make under the median income I can wipe away your debt through a chapter 7 bankruptcy and if you are a high wage earner or have too many assets to file a chapter 7 and be able to keep everything then we can lower your payment to your disposable monthly income which is almost always considerably lower than 25% of your wages. I would say 5-10 % is much more common when you are doing a chapter 13 bankruptcy and I have got plans confirmed with 1-2 % of income going into the plan. Call me to get a free case evaluation.

Answering a lawsuit to buy time to settle

I recently had to answer a law suit filed by Chase on behalf of my client that we are doing debt negotiations on. The answering of the suit will likely buy us 3-4 months to make any payment and hopefully come up with a better offer then what they had initially proposed. I’m wondering if the reason they sued my client so quickly is because they pulled her husbands credit report and saw that he had settled all of his accounts within the last 18 months. I settled 200,000 dollars worth of debt to about 55,000 with him and had just started to work on his wifes account. Chase sued her within 2 months of me starting on her case. Unfortunately this was the biggest account at around 20k of the 50k she had in debt. What we’ve now done is worked out 30% settlements on 2 other cards which saved her 14,000 dollars and we will pay off one other card next month when she has money. This will now leave only Chase to deal with and hopefully after my affirmative defenses and denial that I wrote to their complaint, they will come down to something more reasonable than the 65% over 3 months they tried to get which was not doable. We’ll see if fighting the case against them and making them spend resources and time instead of the typical default judgment that they get will ruffle their feather enough to come down to 40%. It will at least buy us some time so she can come up with larger payments. Sometimes you have to fight these things and that is why having an attorney by your side instead of a debt settlement company is the way to go. The crazy thing is I charge less than most of the debt settlement companies out there. Talk to a riverside county bankruptcy/debt settlement attorney if you have been sued or need financial representation in dealing with your creditors

Riverside County Loan Modification, Don’t wait on it know your options in bankruptcy

I am predicting that the tide of bankruptcies will not be falling anytime soon based on the new numbers that came out in June 2010. Overall California’s unemployment rate decreased to 12.3% according to data that was released by the California unemployment development department. That’s a .1% decrease and a year ago the unemployment rate was 11.6%. Riverside county’s unemployment rate grew to 14.5% which is .5% up from a month before. I also recently read that 10% of homes in Riverside county are 90 days or more deliquent on their mortgage payments. The data spells trouble for people who have lost their jobs or who are currently working with lenders on modifications. Remember that bankruptcy is a right and is something that should be considered a tool to help move out of the current situation that we are in. Our economy is based on consumer spending and when consumers can’t open their wallets due to old obligations that are unlikely to be paid its better to take the pain quickly then to walk around on a broken leg for years. My personal feeling is that the banks are dragging people along and giving them false hope of a modification which are often meaningless so that they don’t have to dump all these excess properties on the market which will depress prices even more and affect the banks. Bankruptcy needs to be looked at as a business decision and people have to let the negative emotions and connotations that are associated with it fall by the wasteside. Getting your family back on track from a new starting point in my opinion is better for the economy than allowing modifications, late payments and collection companies to prosper in an environment that ultimately hurts everyone.

Economic distress eased in August but bankruptcy numbers remain unchanged

According to a yahoo finance article

economic distress eased although unemployment ticked up and foreclosures likely only slowed down from banks delaying proceedings. Many banks foreclosure methods are being questioned as many banks through MERS are having standing issues in trying to foreclose as well as the affidavits that were being signed were not by people who necessarily had knowledge of the foreclosure file which is required. It will be interesting to see how the slow down in foreclosures that is likely to come will affect the economy and house prices in general. Some economists think the banks have exacerbated the problem by foreclosing too quickly and putting distressed properties back into the market at a rate they can’t be absorbed while others believe that its best to get out of this thing quickly so we can see a real road to recovery instead of a double dip. No matter what your take on it, there are still many home owners struggling to pay their mortgage and bankruptcy is a great way to buy some time and get your financial house back in order. Call a riverside county bankruptcy attorney if you are having problems modifying your loan or need any other help in trying to stay in your home while these economic times remain fragile

File for bankruptcy while the economy is down don’t wait

Filing for bankruptcy is never an easy decision but if things are starting to get better for you economically but you are still mired in debt then there is no time like the present to get bankruptcy advice from a riverside county bankruptcy attorney. The type of bankruptcy you qualify for depends on your last six months of income and once things start getting better if getting out of previous debt is still a priority, its likely you’ll be in a five year plan and subject to a restricted budget. Chapter 13 offers many benefits but its nice to be able to make the decision to choose between a chapter 7 or chapter 13 and by waiting until your income goes back up, it might be a choice you won’t have.

Cram down your car in a chapter 13

Cramming down a car in a chapter 13 is a great way to save money and also reduce your disposable monthly income so that you have a cheaper plan payment. If your car is more than 910 days from when you financed it, then you can pay what the car is currently worth on kelly’s blue book or your opinion based on damage etc. Chapter 13 will allow you to pay it off over 5 years instead of the time that you have left which can really lower your payments. It will also help you with reducing disposable monthly income because if you have a financed car then you get a deduction of 496 dollars minus what your car payment is divided over 60 months or 36 months if you are below the median income for your family size. If you own your car outright the ownership expense is much less so it actually helps to keep a financed car through a chapter 13. Chapter 7 allows you to keep your car and continue to make finance payments but you can’t bring it down to current market value.

Banks stop foreclosures in 23 states

Foreclosures will slow down throughout Country with recent developments but not so fast for California homeowners.

While news of foreclosures slowing down based on banks and lawyers questionable methods is great news it won’t be helping Califonia homeowners as much as other states. California has non-judicial foreclosure which means that within a deed of trust there is typically a power of sale cause. After a notice of default, the owner of the property(bank) will typically sell the property at a trustee notice of sale which gives the borrower 21 days. At a trustee sale, the lender will typically bid the amount that is due plus costs if there is not a bidder. The borrower has no right of redemption and deficiency judgments maybe purused in non-judicial foreclosure. That essentially means that the lender can sue you for their loss on the property and you could get a 1099C for their loss which can sometimes have the effect of making you accountable for their loss as income for tax purposes in the following year.

The issue the banks are facing on judicial foreclosures are that people are signing afffadavits about documents that they are not familiar with and have not reviewed. The affadavits say certain facts about the case including what is owed which signer says he has personal knowledge of. They are doing this to the tune of 10,000 affadavits a month which they could clearly not have personally reviewed in order to get a summary judgment and avoid going to trial which is more expensive. They tried to streamline the machine of foreclosures and in the midst they perverted the justice system. The banks in their carelessness have shown. Foreclosure attorneys have been questioning the standing of MERS(mortgage Electronic recording system) for years and have had some success so this ruling by judges who have timely questioned banks foreclosure processes which will help homeowners. As a bankruptcy attorney it will likely not allow me to delay filing petitions so I can keep home owners in their homes longer because the trustee sales will go an as usual since lenders almost always foreclose outside of the judicial system. Many people who live in their homes for free while the bank drudges through the foreclosure process are able to put their financial houses back in order. For states with judicial foreclosure this will be a relief for homeowners who try to rebuild their savings and move on with their lives after falling off a cliff with the loss in equity that their homes went through.

Close out wells fargo Bank Accounts before filing Bankruptcy

I was just reminded the other day by a client that had his Wells Fargo account frozen upon his filing the need to close out Wachovia or Wells Fargo accounts before you file. While it doesn’t affect your ability to keep your money typically, it can be a real pain and put you in a predicament if bills are due and you don’t have incoming money. Wells Fargo for some reason feels like they need to act a trustee for your bank accounts upon the filing of a bankruptcy. Credit unions can do this as well, and I have heard of Union Bank doing the same thing. It ties your money up until the trustee signs off that they were exempt funds. This can take a few days to up to 3 weeks so if you are filing and you have an active account with Wells Fargo take your money out and put them in a different bank account. I typically let my clients know that if you owe money to a bank that you have money in such as credit union credit card and credit union bank account they can set off the funds you owe them with the funds in your account. I always look for accounts owed and bank accounts with the same institution. The client I forgot to warn about as we did the petition really quickly to stop a wage garnishment only owed money to AMEX and I forgot that Wells in notorious for freezing accounts. Fortunately the money is exempt and he’s paid in two days(new money that comes in is not frozen). We will have to have the trustee sign off that the money is exempt and he’ll have it back within a week or so, but heed this warning that Wells Fargo will freeze your account upon the filing of a chapter 7 petition.

Riverside County Bankruptcy Lawyer Blog

Riverside County Bankruptcy Lawyer Blog